Fund Soars 30%+: Is Spring Coming for Hong Kong Internet Stocks?

In early November, the Hong Kong stock market launched a major counteroffensive, with the internet sector leading the charge. Many funds have hopped on this east wind, and the net value of the funds h...

In early November, the Hong Kong stock market launched a major counteroffensive, with the internet sector leading the charge. Many funds have hopped on this east wind, and the net value of the funds has soared continuously.

Among the various funds, the one with the most outstanding performance is the Harvest Hong Kong Internet Industry Core Assets Mixed Fund. As of December 23, the fund's increase since early November has reached as high as 32.21%.

Looking at the fund's holdings, at the end of the third quarter, Hong Kong stocks accounted for a very high proportion of the fund's assets. Meituan-W, Tencent Holdings, Cloud Music, and Kuaishou-W are respectively the fund's first, second, fifth, and seventh largest positions, and compared with the second quarter, each stock has increased its holdings.

In fact, as early as the third quarter, the fund manager expressed his optimism for the Hong Kong internet sector. Manager Wang said in the quarterly report that Munger once said that the first rule of fishing is to go to a pond with fish. The Hong Kong stock market is this pond with big fish, and the internet, innovative drugs, and other new economies are the characteristic growth tracks of the Hong Kong stock market. This time, the fund manager's persistence has paid off, and the fund has won the top prize in terms of returns.

Why has the Hong Kong internet sector made a big comeback?

From a policy perspective, the overall regulatory signals have become more positive, and investors' concerns have gradually been released. In December, the high-level economic meeting clearly stated, "Vigorously develop the digital economy, improve the level of regular regulation, and support platform companies to play a big role in leading development, creating jobs, and international competition." The high-level encouragement for the development of the platform economy has been further released. Such policy statements are significantly different from last year, and the regulatory policies for platform companies are gradually warming up, and the valuation repair of the sector is a natural thing.

It is worth mentioning that there has also been a substantial breakthrough in the cooperation between China and the United States on audit supervision. On December 15 (US time), the US Public Company Accounting Oversight Board (PCAOB) published a report on its official website stating that it had obtained the audit rights of Chinese concept stocks for the first time, confirming that it could obtain unrestricted audit rights for accounting firms in mainland China and Hong Kong in 2022, and revoked its decision at the end of 2021 that it could not audit related firms. This move not only lays a solid foundation for the cooperation between Chinese and American audit supervision but also helps to eliminate the risk of Chinese concept stocks being delisted due to audit issues, thus supporting the emotional repair of Hong Kong stocks and Chinese concept stocks.

From a funding perspective, China's epidemic prevention policies continue to be optimized, and economic expectations are gradually rising. With the recovery of the domestic economy and the repair of the epidemic, the profit growth rate of Hong Kong stocks is expected to recover. In addition, professionals predict that US inflation has reached a turning point, and if US monetary policy can turn because of this, it will also release the liquidity of Hong Kong stocks to a certain extent.

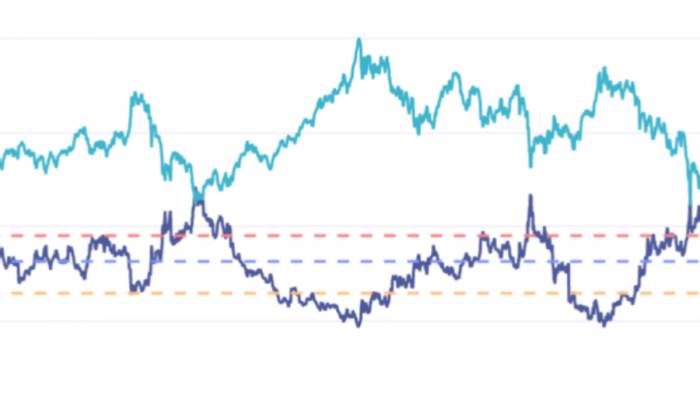

From a valuation perspective, although it has risen since November, the current valuation of Hong Kong stocks is still at a historical low. Data shows that as of December 22, 2022, the current PE (TTM) of the Hang Seng Index is 9.39 times, still at a historical percentile of 28.41%, with a low valuation. The main indices of Hong Kong stocks have only repaired to the position around September this year, and there is still a large decline within the year.

With the warming of the Hong Kong stock market, how can investors who want to participate in the layout? From an investment perspective, the valuation logic of Hong Kong stocks is different from that of A-shares, and there are no restrictions on price limits. In addition, Hong Kong stocks can also be shorted, and sometimes the fluctuations are large, and investors have a high level of professionalism. At present, Hong Kong stocks are still biased towards global pricing, and when their own fundamentals are poor, they may be affected by the operations of the Federal Reserve. It is suitable for friends with medium to high risk tolerance to choose.In summary, although the Hong Kong stock market's internet sector has experienced a significant surge and may face some volatility in the near term, it still offers relatively attractive investment value from both valuation and fundamental perspectives. For investors who can tolerate medium to high risks, we can invest through funds to capture opportunities in this sector!